For our February Member Spotlight, we talked to the Nebraska Department of Economic Development about their Renewable Chemical Production Tax Credit Act.

Tell us about the Department’s Renewable Chemical Production Tax Credit Act.

The Renewable Chemical Production Tax Credit Act (“RCPTCA”) is intended to stimulate the emerging biotechnology and bioproducts sector in Nebraska and incentivize the development of renewable chemicals. The Nebraska Department of Economic Development (“DED”) can award up to six million dollars in tax credits per year under the RCPTCA. Currently, Nebraska is one of very few states that offer tax incentives specifically for renewable chemical production. The RCPTCA offers the highest credit earn rate of $0.075 per pound produced and the highest annual award of up to $1.5 million per year per applicant. Through the RCPTCA, Nebraska is also one of the only states that offers a refundable tax credit for renewable chemical production. DED is actively seeking producers that pursue renewable chemical production to increase the sustainability and diversity of renewable industries, jobs, and production in Nebraska.

Why is Nebraska an important location for renewable chemicals?

Nebraska provides a selection of rich locations, with close access to biomass feedstock, strong infrastructure, reliable energy, and an educated and hardy workforce. The renewable chemical industry is growing, and Nebraska can boast of the key resources necessary to support that growth.

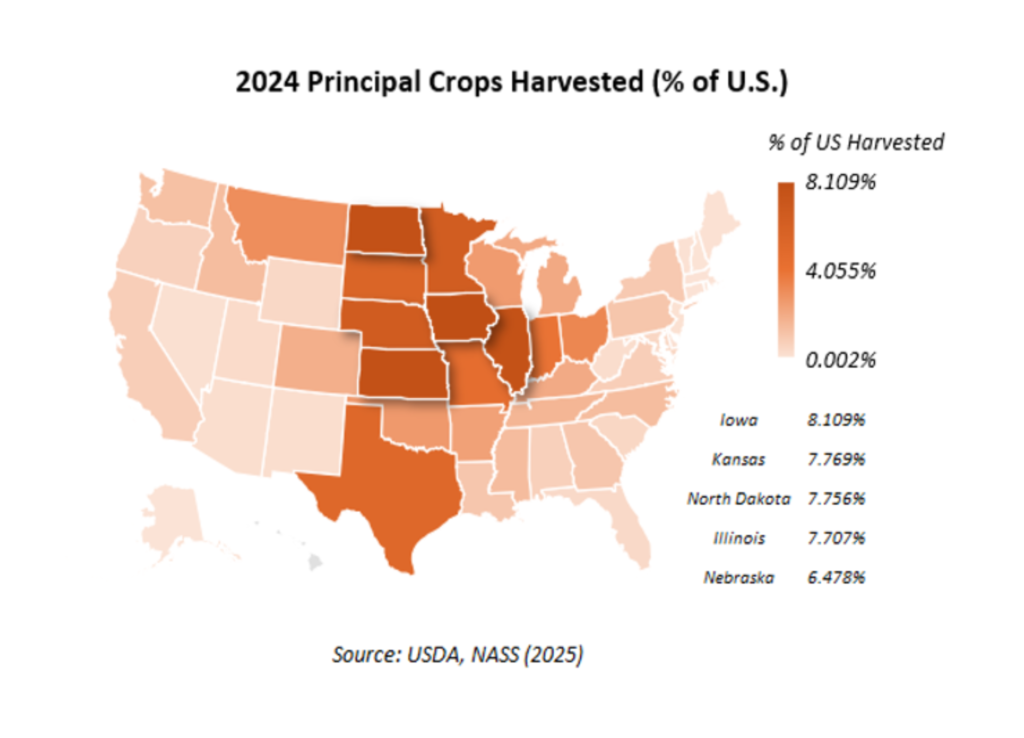

In 2024, Nebraska jumped to the 5th most contributing state for principal crops harvested in the United States, according to USDA/NASS Annual Crop Yield Reports. Indeed, 2024 was a phenomenal year for growth, network expansion, and investment in our bioeconomy. Last year, Nebraska hosted the Plant-Based Product Council’s annual meeting and the World Bio Markets’ inaugural U.S. conferences (Bio Innovations Midwest). This was a valuable opportunity to showcase Nebraska’s bioeconomy and its affiliated businesses.

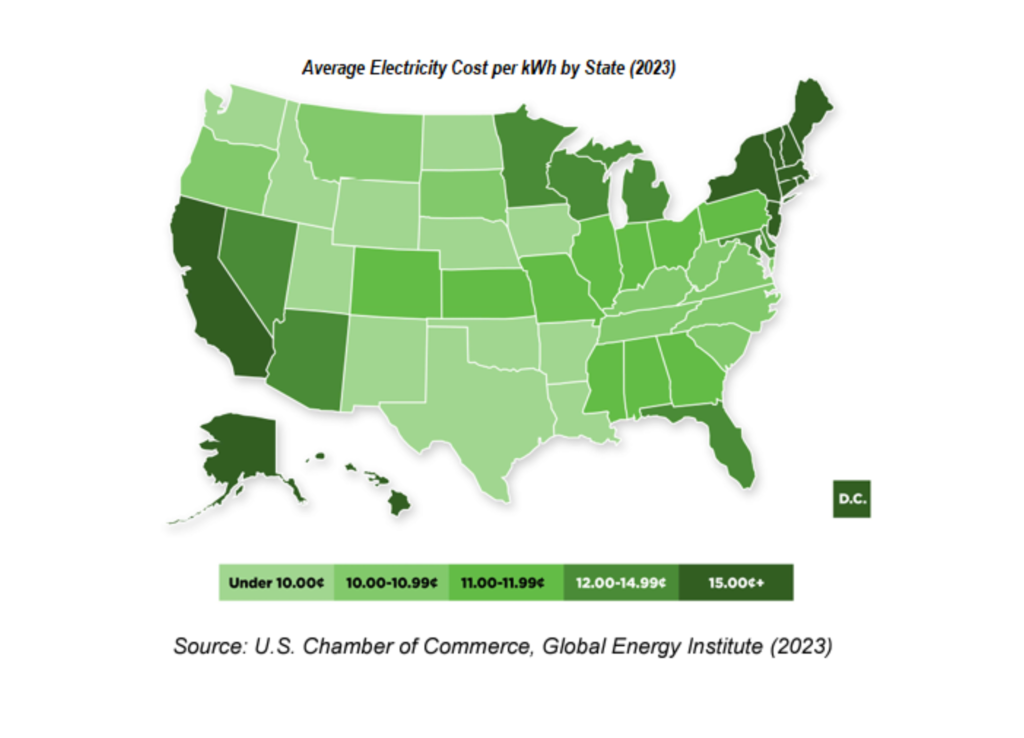

World Bio Market Insights published an article describing the state as an “agricultural powerhouse.” According to Nebraska’s Energy Future-Introduction and Executive Summary, “the state is poised for additional industrial growth on this agricultural base,” stating Nebraska’s electricity as “among the most affordable and reliable in the country.” Praised for its great business climate, workforce, steady economic growth, infrastructure, resource availability, and research and technology support, Nebraska has proven time and time again to be a prime location for biomanufacturing and is proud to work with many leading bio-giants.

The Department of Economic Development is a proud supporter of innovation and progress and offers an all-encompassing path to success for your community or business, including incentives that aid in workforce, infrastructure, community, research, youth, talent recruitment, and individual business development. In turn, the state has seen an increase in job creation, revenue, and economic growth.

What is considered a renewable chemical in the RCPTCA?

Chemical eligibility is determined on a case-by-case basis and is verified by a chemist at the University of Nebraska upon application.

In accordance with statute, a renewable chemical is a molecule that is converted from a sugar, starch, polysaccharide, glycerin, lignin, fat, grease, or oil derived from plants, animals, algae, or a protein capable of being converted to a first- or secondarily-derived product that can be further refined into a higher-value chemical, material, or consumer product by means of a biological or chemical conversion process with a significant biobased content that can be used for products including polymers, plastics, food additives, solvents, intermediate chemicals, or other formulated products with a significant nonfossil carbon content. A renewable chemical includes biobased chemicals that can be food, feed, or fuel additives and supplements, vitamins, nutraceuticals, and pharmaceuticals.

It is important to note that ethanol production is not eligible under the RCPTCA. Under the Act, a renewable chemical does not include chemicals sold or used as fuel.

Who is eligible for the RCPTCA?

In order to be eligible to receive tax credits for the production of renewable chemicals, the applicant must produce at least one million pounds of renewable chemicals in Nebraska during the calendar year for which tax credits are sought. The applicant must be physically located in Nebraska and have organized, expanded, or located in Nebraska on or after January 1, 2021. The applicant must also be compliant with all agreements entered into under the RCPTCA and any other tax credit or programs administered by the Nebraska Department of Economic Development or the Nebraska Department of Revenue.

With year-long application periods, applicants can reapply every calendar year until the annual tax credit limitation has been reached. There is no application fee.

Applications must be submitted electronically using the Department of Economic Development’s Grant Management System, which can be found on our website.

Who should I contact if I’m interested?

If you are interested in supporting the growth of renewable chemicals in the State of Nebraska, you can email [email protected] or call (402) 471-3794 to speak with the RCPTCA program manager, Madeline Adkins.

For the most up-to-date information on the DED’s incentive programs, visit our website at https://opportunity.nebraska.gov/.

We hope to hear from you soon!